A) discretionary monetary policy is ineffective because of its long identification lag.

B) discretionary fiscal policy is ineffective because of its long recognition lag.

C) discretionary monetary policy is ineffective because of its long implementation lag.

D) discretionary fiscal policy is ineffective because of its long implementation lag.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A contractionary fiscal policy will reduce a government budget deficit or increase a government budget surplus and lower the quantity of bonds the government must sell.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy has a recessionary gap. If supply-side effects are very strong in relation to the demand-side effects,

A) the impact of tax cuts will be strengthened because the increase in disposable income induces consumption, which in turn encourages firms to expand production, thereby shifting the short-run aggregate supply curve to the right.

B) the impact of tax cuts will be strengthened because in addition increasing aggregate demand, long-run and short-run aggregate supply will also increase.

C) the impact of increased transfer payments to help re-tool the unemployed with new skills will be strengthened, thereby shifting the aggregate demand curve further to the right.

D) the impact of increased transfer payments to help re-tool the unemployed with new skills will be strengthened, thereby shifting the short-run aggregate supply curve to the right.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

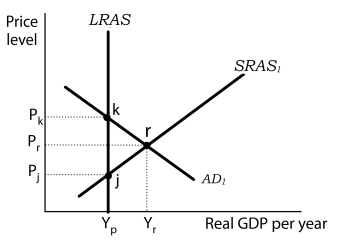

Figure 12-2  -Refer to Figure 12-2. If real GDP is equal to Yr, there is

-Refer to Figure 12-2. If real GDP is equal to Yr, there is

A) an inflationary gap.

B) a recessionary gap.

C) equilibrium at full employment.

D) a short-run and a long-run equilibrium.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recognition lags in fiscal policy stem largely from

A) the fact that it takes time before a fiscal policy, such as a change in government purchases or a change in taxes, is agreed to and put into effect.

B) the fact that it takes time for a policy action to have its full effect on aggregate demand.

C) the difficulty of collecting economic data in a timely and accurate fashion.

D) households and businesses may not respond to fiscal policy to the extent that policy makers had hoped, for example, they may not be as responsive to a tax cut .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As populations age, the burden of current fiscal policy in many countries is increasingly borne by

A) younger people in the population.

B) older people in the population.

C) the government.

D) new immigrants into a country.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following contributes to implementation lag for discretionary fiscal policy?

A) the time it takes to secure legislative approval for policy actions

B) the time it takes for economic agents to respond to policy actions

C) the difficulty of collecting economic data in a timely manner

D) the time it takes to borrow funds to finance the fiscal policy

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Public investment expenditure for highways, schools, and national defense is included in which component of GDP?

A) consumption

B) gross private investment

C) government purchases

D) public investment

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The national debt

A) is the difference between total government revenues and government expenditures.

B) is the sum of all past federal deficits plus any surpluses.

C) is the sum of all past federal deficits less any surpluses.

D) grows when government spending increases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Personal income and payroll taxes are the largest sources of revenue for the federal government.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changes in expenditures and taxes that occur through automatic stabilizers

A) shift the aggregate demand curve to the right in the event of an economic expansion.

B) shift the aggregate demand curve to the left in the event of an economic contraction.

C) do not shift the aggregate demand curve.

D) cause a movement up along the aggregate demand curve the event of an economic expansion and a movement down along the aggregate demand curve the event of an economic contraction.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

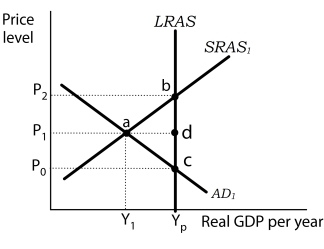

Figure 12-1  -Refer to Figure 12-1. In this situation, if policymakers want to close the output gap with fiscal policies that will stimulate aggregate demand, what should they do?

-Refer to Figure 12-1. In this situation, if policymakers want to close the output gap with fiscal policies that will stimulate aggregate demand, what should they do?

A) establish a consumption tax to encourage savings

B) increase government spending

C) loosen environmental regulations to lower businesses cost of production

D) raise interest rates

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the economy experiences a recessionary gap. Policymakers who believe that Government is too big would favor which of the following policies to close the gap?

A) decreases in transfer payment

B) decreases in income tax rates

C) increases in government purchases

D) increases in interest rates

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Expansionary fiscal policy leads to an increase in net exports, all other things unchanged.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a country has a national debt of $2,000 billion, a GDP of $28,000 billion, and a Budget deficit of $115 billion. How much will its new national debt be?

A) $2,115 billion

B) $1,885 billion

C) $28,115 billion

D) $25,885 billion

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An inflationary gap can be closed with

A) using an expansionary monetary policy.

B) using a policy action such as a reduction in taxes.

C) using a policy action such as a reduction in government purchases.

D) imposing price controls to prevent prices from rising.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The provision of aid to an individual who is not required to provide anything in exchange is called a transfer payment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If there is a recessionary gap, the appropriate fiscal policy would be contractionary.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An inflationary gap may be eliminated using contractionary fiscal policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government purchases component of aggregate demand includes I. all purchases by government agencies of goods and services produced by firms. II. direct production by government agencies themselves. III. government expenditures on transfer payments.

A) I only

B) I and II only

C) I and III only

D) I, II, and III

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 181

Related Exams