A) $60.25.

B) $60.75.

C) $61.33.

D) $64.00.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the MPC is 5/6 then the multiplier is

A) 6/5, so a $200 increase in government spending increases aggregate demand by $240.

B) 5, so a $200 increase in government spending increases aggregate supply by $1000.

C) 6, so a $200 increase in government spending increases aggregate demand by $1200.

D) 6/5, so a $200 increase in government spending increases aggregate supply by $1200.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, if the price level

A) fell, the interest rate would rise, and induce investment spending to rise.

B) fell, the interest rate would fall, and induce investment spending to fall.

C) rose, the interest rate would rise, and induce investment spending to fall.

D) rose, the interest rate would fall, and induce investment spending to rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The opportunity cost of holding money

A) decreases when the interest rate decreases, so people desire to hold more of it.

B) decreases when the interest rate decreases, so people desire to hold less of it.

C) increases when the interest rate decreases, so people desire to hold more of it.

D) increases when the interest rate decreases, so people desire to hold less of it.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The G20 countries introduced stimulus packages that averaged ____ of GDP in 2009 and ____ in 2010.

A) 2%; 1.6%

B) 1.6%; 2%

C) 3%; 2%

D) 2%; 3%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the interest rate decreases, the opportunity cost of holding money

A) increases, so the quantity of money demanded increases.

B) increases, so the quantity of money demanded decreases.

C) decreases, so the quantity of money demanded increases.

D) decreases, so the quantity of money demanded decreases.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to liquidity preference theory, the slope of the money demand curve is explained as follows:

A) Interest rates rise as the Fed reduces the quantity of money demanded.

B) Interest rates fall as the Fed reduces the supply of money.

C) People will want to hold less money as the cost of holding it falls.

D) People will want to hold more money as the cost of holding it falls.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the "animal spirits" described by Keynes, when optimism reigns, households and firms

A) increase spending which results in inflationary pressures.

B) decrease spending which results in deflationary pressures.

C) increase spending which results in deflationary pressures.

D) decrease spending which results in inflationary pressures.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correctly explains the crowding-out effect?

A) An increase in government expenditures decreases the interest rate and so increases investment spending.

B) An increase in government expenditures increases the interest rate and so reduces investment spending.

C) A decrease in government expenditures increases the interest rate and so increases investment spending.

D) A decrease in government expenditures decreases the interest rate and so reduces investment spending.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People might withdraw money from interest-bearing accounts,

A) making the interest rate fall, if there is a surplus in the money market.

B) making the interest rate rise, if there is a surplus in the money market.

C) making the interest rate fall, if there is a shortage in the money market.

D) making the interest rate rise, if there is a shortage in the money market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The government builds a new water-treatment plant. The owner of the company that builds the plant pays her workers. The workers increase their spending. Firms from which the workers buy goods increase their output. This type of effect on spending illustrates

A) the multiplier effect.

B) the crowding-out effect.

C) the Fisher effect.

D) the wealth effect.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If, at some interest rate, the quantity of money demanded is less than the quantity of money supplied, people will desire to

A) sell interest-bearing assets, causing the interest rate to decrease.

B) sell interest-bearing assets, causing the interest rate to increase.

C) buy interest-bearing assets, causing the interest rate to decrease.

D) buy interest-bearing assets, causing the interest rate to increase.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government purchases are said to have a

A) multiplier effect on aggregate supply.

B) multiplier effect on aggregate demand.

C) liquidity-enhancing effect on aggregate supply.

D) liquidity-enhancing effect on aggregate demand.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following policy alternatives would be an appropriate response to a sharp increase in investment spending, assuming policymakers want to stabilize output?

A) increase taxes

B) increase the money supply

C) increase government expenditures

D) All of the above are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

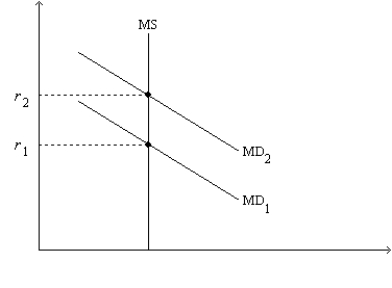

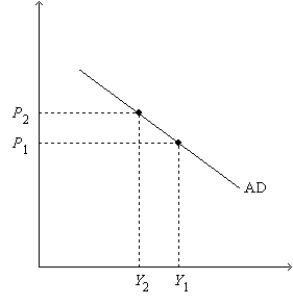

Figure 34-2. On the left-hand graph, MS represents the supply of money and MD represents the demand for money; on the right-hand graph, AD represents aggregate demand. The usual quantities are measured along the axes of both graphs.

.

-Refer to Figure 34-2. Assume the money market is always in equilibrium. Under the assumptions of the model,

-Refer to Figure 34-2. Assume the money market is always in equilibrium. Under the assumptions of the model,

A) the real interest rate is lower at Y2 than it is at Y1.

B) the quantity of money is the same at Y1 as it is at Y2.

C) the price level is lower at r2 than it is at r1.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of the following cases does the aggregate-demand curve shift to the right?

A) The price level rises, causing the interest rate to fall.

B) The price level falls, causing the interest rate to fall.

C) The money supply increases, causing the interest rate to fall.

D) The money supply decreases, causing the interest rate to fall.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using the liquidity-preference model, when the Federal Reserve increases the money supply,

A) the equilibrium interest rate decreases.

B) the aggregate-demand curve shifts to the left.

C) the quantity of goods and services demanded is unchanged for a given price level.

D) the short-run aggregate-supply curve shifts to the right.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the MPC is 4/5, the multiplier is 5/4.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The interest-rate effect is partially explained by the fact that a higher price level reduces money demand.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the marginal propensity to consume is 6/7, then the multiplier is 7.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 523

Related Exams