A) relying on voluntary compliance

B) taxing the output of industries that pollute

C) creating legal environmental standards

D) increasing public spending on cleanup and reduction of pollution

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the most effective way to internalize a technology spillover?

A) taxes

B) patents

C) government regulations

D) free markets

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Government intervention is necessary to correct all externalities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that an MBA degree creates no externality because the benefits of an MBA are internalized by the student in the form of higher wages.If there are no government subsidies for MBAs,then which of the following statements is correct?

A) The equilibrium quantity of MBAs will equal the socially optimal quantity of MBAs.

B) The equilibrium quantity of MBAs will be greater than the socially optimal quantity of MBAs.

C) The equilibrium quantity of MBAs will be less than the socially optimal quantity of MBAs.

D) There is not enough information to answer the question.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

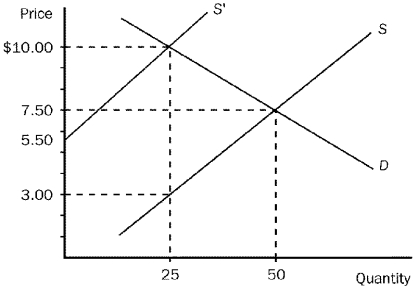

Figure 10-2

-Refer to Figure 10-2.Suppose that the production of soccer balls creates a social cost which is depicted in the graph above.If the government wanted to force the firm to internalize the cost of the externality,what action should it take?

-Refer to Figure 10-2.Suppose that the production of soccer balls creates a social cost which is depicted in the graph above.If the government wanted to force the firm to internalize the cost of the externality,what action should it take?

A) Impose a tax of $7.50 per soccer ball.

B) Impose a tax of $7 per soccer ball.

C) Offer a subsidy of $3 per soccer ball.

D) Offer a subsidy of $2.50 per soccer ball.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An externality is an example of

A) a corrective tax.

B) a tradable pollution permit.

C) a market failure.

D) Both a and b are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that a firm produces electricity by burning coal.The production process creates a negative externality of air pollution.If the firm does not internalize the cost of the externality,it will produce where

A) the value of electricity to consumers equals the private cost of producing electricity.

B) the value of electricity to consumers equals the social cost of producing electricity.

C) the cost of the externality is maximized.

D) the transaction costs of private bargaining are minimized.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dioxin emission that results from the production of paper is a good example of a negative externality because

A) self-interested paper firms are generally unaware of environmental regulations.

B) there are fines for producing too much dioxin.

C) self-interested paper producers will not consider the full cost of the dioxin pollution they create.

D) toxic emissions are the best example of an externality.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If it is illegal for a biochemical manufacturer to release its waste into a nearby stream,then this is an example of

A) a market-based policy.

B) a command-and-control policy.

C) tradable pollution permits.

D) transaction costs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two firms,A and B,each currently dump 50 tons of chemicals into the local river.The government has decided to reduce the pollution and from now on will require a pollution permit for each ton of pollution dumped into the river.It costs Firm A $100 for each ton of pollution that it eliminates before it reaches the river,and it costs Firm B $50 for each ton of pollution that it eliminates before it reaches the river.The government gives each firm 20 pollution permits.Government officials are not sure whether to allow the firms to buy or sell the pollution permits to each other.What is the total cost of reducing pollution if firms are not allowed to buy and sell pollution permits from each other? What is the total cost of reducing pollution if the firms are allowed to buy and sell permits from each other? You should assume that any firm that buys a permit pays the highest price for that permit.

A) $3,000; $1,500

B) $4,500; $3,500

C) $4,500; $4,000

D) $4,500; $2,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In many cases selling pollution permits is a better method for reducing pollution than imposing a corrective tax because

A) it is hard to estimate the market demand curve and thus charge the "right" corrective tax.

B) selling pollution permits create a net increase in pollution.

C) Corrective taxes distort incentives.

D) Corrective taxes provide greater flexibility to firms that can reduce pollution at a low cost.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a positive externality?

A) air pollution

B) a person littering in a public park

C) a nice garden in front of your neighbor's house

D) the pollution of a stream

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Private markets fail to account for externalities because

A) externalities don't occur in private markets.

B) sellers include costs associated with externalities in the price of their product.

C) decisionmakers in the market fail to include the costs of their behavior to third parties.

D) the government cannot easily estimate the optimal quantity of pollution.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a paper manufacturer does not bear the entire cost of the dioxin it emits,it will

A) emit a lower level of dioxin than is socially efficient.

B) emit a higher level of dioxin than is socially efficient.

C) emit an acceptable level of dioxin.

D) not emit any dioxin in an attempt to avoid paying the entire cost.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When externalities cause markets to be inefficient,

A) government action is always needed to solve the problem.

B) private solutions can be developed to solve the problem.

C) given enough time, externalities can be solved through normal market adjustments.

D) there is no way to eliminate the problem of externalities in a market.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

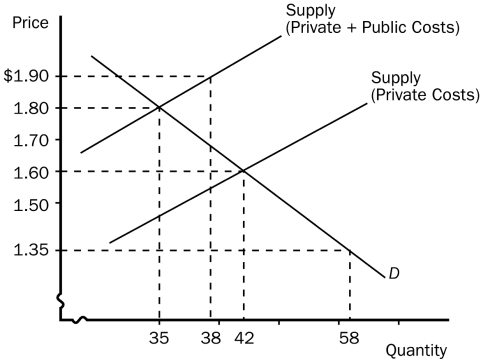

Figure 10-1

-Refer to Figure 10-1.This graph represents the tobacco industry.The socially optimal price and quantity are

-Refer to Figure 10-1.This graph represents the tobacco industry.The socially optimal price and quantity are

A) $1.90 and 38 units, respectively.

B) $1.80 and 35 units, respectively.

C) $1.60 and 42 units, respectively.

D) $1.35 and 58 units, respectively.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government were to limit the release of air-pollution produced by a steel mill to 75 parts per million,the policy would be considered a

A) regulation.

B) corrective tax.

C) subsidy.

D) market-based policy.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If education produces positive externalities,we would expect

A) the government to tax education.

B) the government to subsidize education.

C) people to realize the benefits, which would increase the demand for education.

D) colleges to relax admission requirements.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) Private markets tend to over-produce products with negative externalities.

B) Private markets tend to under-produce products with positive externalities.

C) Private parties can bargain to efficient outcomes even in the presence of externalities.

D) Private parties are usually more successful in achieving efficient outcomes than government policies.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corrective taxes that are imposed upon the producer of a nasty smell can be successful in reducing that smell because the tax makes the producer

A) externalize the positive externality.

B) externalize the negative externality.

C) internalize the positive externality.

D) internalize the negative externality.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 288

Related Exams