A) original issue deep discount bonds

B) extendible notes

C) convertible bonds

D) floating rate notes

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Potential sellers of an asset can be represented as a ____ schedule showing the ____ prices at which they are willing to sell given quantities of the asset.

A) supply, maximum

B) demand, maximum

C) supply, minimum

D) supply, average

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following types of bonds are secured except

A) collateral trust

B) mortgage

C) debentures

D) equipment trust certificates

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marko needs to raise capital through a zero-coupon bond debt offering. If the bonds will have 12 years to maturity and the rate of return on a bond in Marko's risk class is 11 percent, what will be the selling price of the bond?

A) $302.50

B) $335.50

C) $269.50

D) $286.00

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

What is the collateral used in collateral trust bonds and who is its primary user?

Correct Answer

verified

Collateral trust bonds are backed by sto...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

Five years ago, the City of Baltimore sold at par a $1,000 bond with a coupon rate of 8 percent and 20 years to maturity. If this bond pays interest semiannually, what is the value of this bond to an investor who requires an 8 percent rate of return?

A) $607.72

B) $692.00

C) $1,000

D) $1,080

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In reading price quotes on U.S. Treasury bills, you would ____ expect to find the "asked" price higher than the "bid".

A) always

B) never

C) sometimes

D) seldom

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

How does a firm value an asset?

Correct Answer

verified

The value of any asset is based on the e...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

The quality of a debenture depends on the

A) general credit-worthiness of the issuing company

B) value of the assets used as collateral

C) the coupon rate of the debenture

D) length of time to maturity

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Junk bond" is a term used to describe a bond that

A) is in default

B) is rated Ba or lower

C) is currently paying interest

D) has been downgraded by Moody's

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the yield to maturity for a Poughkeepsie Gypsy Fortune Tellers' zero coupon bond that matures in 14 years if the bond is selling for $530.00?

A) 5.84%

B) 4.64%

C) 4.28%

D) 5.49%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

National Medical has a zero coupon bond outstanding that sells for $242.60 and has 15 years to maturity. What is the yield to maturity on the bond to the nearest tenth of one percent?

A) 10.5%

B) 9.1%

C) 9.9%

D) 11.0%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unsecured income bonds are considered ________________securities.

A) strong

B) government

C) weak

D) non-corruptible

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of a 15-year bond will change ____ for a given change in the required rate of return than the value of a 5 year bond.

A) more

B) less

C) the same percentage

D) exactly the same

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the yield-to-maturity of an Acme bond selling for $1107.50 with 5 years to maturity, a 12 1/2% coupon, and semi-annual compounding?

A) 10.36%

B) 11.29%

C) 9.74%

D) 10.20%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Users of preferred stock include:

A) Utility companies

B) Acquiring firm in mergers and acquisitions

C) Large commercial banks

D) All of the above are users

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The call feature is an advantage to the issuing firm

A) if the bond has a floating rate

B) if interest rates decline

C) if the bond has a low par value

D) if interest rates increase

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What would a GMA 6% coupon bond maturing in 14 years sell (approximately) for if the current yield is 6.8633% and the yield-to-maturity is 7.48%?

A) $950.20

B) $920.02

C) $1051.54

D) $874.21

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

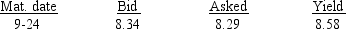

In the Treasury bill quote that follows, the price of the bill can be calculated from the ____ price.

A) bid

B) asked

C) yield

D) none of the above

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The State of Adaven issued $50 million of perpetual bonds in 1990. The bonds were issued in $100 denominations with an annual coupon interest rate of 5%. Determine the value of these bonds today to an investor who requires a 10% return on his investment.

A) $25

B) $5

C) $10

D) $50

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 126

Related Exams