A) the government will not have to repay the privately held debt.

B) only the privately held debt creates a net interest liability for the federal government.

C) the privately held debt does not create a net interest liability for the federal government.

D) taxes will have to be raised in order to pay the interest on the debt held by the Federal Reserve system.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If households fail to recognize that debt-financing represents a future liability (in the form of higher taxes) , they will tend to consume

A) less and pass less net wealth on to future generations.

B) more and pass more net wealth on to future generations.

C) less and pass more net wealth on to future generations.

D) more and pass less net wealth on to future generations.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sum of all past budget deficits and surpluses of the federal government is the

A) budget deficit.

B) budget surplus.

C) national debt.

D) trade deficit.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

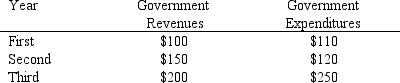

The table below shows the revenues and expenditures for a new country during its first three years of existence. Use this data to answer the following question(s) .

Table ST8-1

-Refer to Table ST8-1. In the first year, this country

-Refer to Table ST8-1. In the first year, this country

A) ran a deficit of $210.

B) had a surplus of $10.

C) ran a deficit of $10.

D) had a surplus of $210.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the 1950s and 1960s, the national debt as a percent of GDP in the United States

A) soared to an all-time high.

B) declined.

C) increased.

D) was virtually unchanged.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is likely to push the federal debt increasingly higher in the coming decades?

A) a strong rebound from the recession of 2008-2009

B) increased expenditures on the Social Security and Medicare programs

C) an increase in tax revenues as the baby boom generation retires

D) increased political pressure to balance federal budgets

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If one subtracts the amount of bonds held by agencies of the federal government and the Federal Reserve from the national debt, what remains is known as the

A) external debt.

B) privately held government debt.

C) trade deficit.

D) budget deficit.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the federal government runs a budget deficit, but the budget deficit as a percent of GDP is less than the growth rate of real output, the

A) national debt will decrease as a share of GDP.

B) national debt will remain a constant share of GDP.

C) national debt will increase as a share of GDP.

D) size of the national debt (in dollar value) will decline.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a budget deficit as a percent of GDP is greater than the growth of real output, the national debt will

A) decrease relative to the size of the economy.

B) decrease in nominal terms.

C) increase in nominal terms but decrease relative to the size of the economy.

D) increase relative to the size of the economy.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The national debt is the

A) difference between a nation's exports and imports of goods and services.

B) sum of the personal debt of all citizens in the United States.

C) indebtedness of the federal government in the form of outstanding interest-earning bonds.

D) sum of the net personal debts of Americans to foreigners.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 2009, the privately held federal debt was approximately what percent of GDP?

A) 11 percent

B) 31 percent

C) 57 percent

D) 100 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the federal government fails to reduce the nation's debt relative to income,

A) it will become easier to borrow in the global credit markets.

B) the interest expenses on the outstanding debt will increase.

C) the cost of holding outstanding debt will decrease.

D) it will be easier to cover the interest on outstanding debt with tax revenues.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currently, the strategy of the Social Security system is to run surpluses to prepare for the retirement of the baby boom generation. The effectiveness of this strategy is being undermined because

A) rising interest rates make it more expensive for Social Security to borrow.

B) inflation is reducing the value of the Social Security surplus.

C) the trust fund is being used to finance current government expenditures, and the bonds held by the trust fund are an obligation of the U.S. Treasury.

D) the federal budget surplus reduces the Social Security surplus.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which country had the lowest government debt as a percent of GDP in 2009?

A) United States

B) Spain

C) United Kingdom

D) Australia

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the revenues and expenditures of the Social Security trust fund were not included when calculating the budget deficit, the recalculated deficit would

A) be larger.

B) be smaller.

C) be unchanged.

D) actually be a surplus.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Widespread acceptance of the Keynesian theory of fiscal policy

A) caused most economists to reject the public choice view of budget deficits.

B) relaxed the political pressure to balance the budget and, hence, paved the way for the persistent budget deficits of the last five decades.

C) was based on the view that continual budget deficits would help stabilize the economy.

D) increased the pressure for a constitutional amendment mandating that the federal government balance its budget.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the new classical view, if people appropriately realize that an increase in government debt implies higher future taxes, they will

A) save less since the substitution of debt for taxes makes them wealthier.

B) increase their consumption since the substitution of debt for taxes makes them wealthier.

C) save more now to meet the future tax liability implied by the increase in debt.

D) alter neither their saving nor their consumption rate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

External debt is that portion of the national debt

A) owed to investors outside the United States (foreign investors) .

B) owed to the Federal Reserve system.

C) that the U.S. does not intend to repay.

D) owed to U.S. citizens and corporations.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

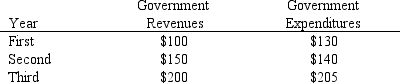

Suppose a new country is formed, and its government has the following revenues and expenditures for its first three years of existence.  Which of the following is correct regarding this government?

Which of the following is correct regarding this government?

A) In the third year, it had a $5 national debt, and after the third year, it has a $25 deficit.

B) In the third year, it ran a $5 deficit, and its national debt after the third year is $45.

C) In the third year, it ran a $5 surplus, and its national debt after the third year is $25.

D) In the third year, it ran a $5 deficit, and its national debt after the third year is $25.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the federal government were to run a budget surplus, this would

A) increase the size of the national debt.

B) reduce the size of the national debt.

C) leave the size of the national debt unchanged.

D) decrease the national debt only if the government also reduces the supply of money.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 97

Related Exams