B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

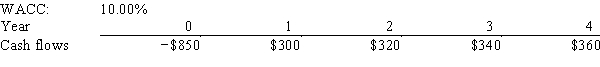

Malholtra Inc.is considering a project that has the following cash flow and WACC data.What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 14.08%

B) 15.65%

C) 17.21%

D) 18.94%

E) 20.83%

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Small businesses make less use of DCF capital budgeting techniques than large businesses.This may reflect a lack of knowledge on the part of small firms' managers,but it may also reflect a rational conclusion that the costs of using DCF analysis outweigh the benefits of these methods for very small firms.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

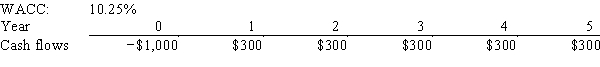

Harry's Inc.is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's projected NPV is negative,it should be rejected.

A) $105.89

B) $111.47

C) $117.33

D) $123.51

E) $130.01

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Because "present value" refers to the value of cash flows that occur at different points in time,a series of present values of cash flows should not be summed to determine the value of a capital budgeting project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects A and B are mutually exclusive and have normal cash flows.Project A has an IRR of 15% and B's IRR is 20%.The company's WACC is 12%,and at that rate Project A has the higher NPV.Which of the following statements is CORRECT?

A) The crossover rate for the two projects must be less than 12%.

B) Assuming the timing pattern of the two projects' cash flows is the same, Project B probably has a higher cost (and larger scale) .

C) Assuming the two projects have the same scale, Project B probably has a faster payback than Project A.

D) The crossover rate for the two projects must be 12%.

E) Since B has the higher IRR, then it must also have the higher NPV if the crossover rate is less than the WACC of 12%.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

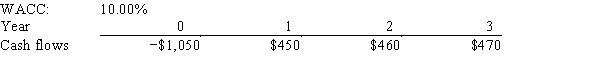

Cornell Enterprises is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that a project's projected NPV can be negative,in which case it will be rejected.

A) $ 92.37

B) $ 96.99

C) $101.84

D) $106.93

E) $112.28

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The internal rate of return is that discount rate that equates the present value of the cash outflows (or costs)with the present value of the cash inflows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

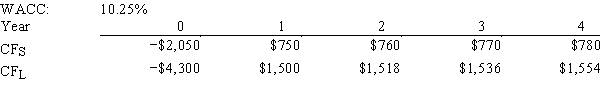

Sexton Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,so no value will be lost if the IRR method is used.

A) $134.79

B) $141.89

C) $149.36

D) $164.29

E) $205.36

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a project has "normal" cash flows, then its IRR must be positive.

B) If a project has "normal" cash flows, then its MIRR must be positive.

C) If a project has "normal" cash flows, then it will have exactly two real IRRs.

D) The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life.

E) If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) One advantage of the NPV over the IRR is that NPV takes account of cash flows over a project's full life whereas IRR does not.

B) One advantage of the NPV over the IRR is that NPV assumes that cash flows will be reinvested at the WACC, whereas IRR assumes that cash flows are reinvested at the IRR. The NPV assumption is generally more appropriate.

C) One advantage of the NPV over the MIRR method is that NPV takes account of cash flows over a project's full life whereas MIRR does not.

D) One advantage of the NPV over the MIRR method is that NPV discounts cash flows whereas the MIRR is based on undiscounted cash flows.

E) Since cash flows under the IRR and MIRR are both discounted at the same rate (the WACC) , these two methods always rank mutually exclusive projects in the same order.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The IRR method is based on the assumption that projects' cash flows are reinvested at the project's risk-adjusted cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

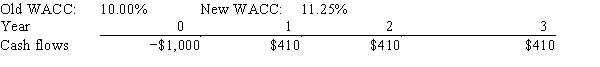

Multiple Choice

Last month,Lloyd's Systems analyzed the project whose cash flows are shown below.However,before the decision to accept or reject the project,the Federal Reserve took actions that changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative,in which case it should be rejected.

A) −$18.89

B) −$19.88

C) −$20.93

D) −$22.03

E) −$23.13

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An increase in the firm's WACC will decrease projects' NPVs,which could change the accept/reject decision for any potential project.However,such a change would have no impact on projects' IRRs.Therefore,the accept/reject decision under the IRR method is independent of the cost of capital.

B) False

Correct Answer

verified

Correct Answer

verified

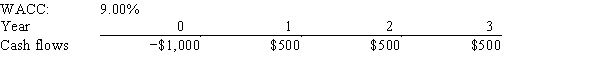

Multiple Choice

Datta Computer Systems is considering a project that has the following cash flow data.What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative) ,in which case it will be rejected.

A) 9.70%

B) 10.78%

C) 11.98%

D) 13.31%

E) 14.64%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If you were evaluating two mutually exclusive projects for a firm with a zero cost of capital,the payback method and NPV method would always lead to the same decision on which project to undertake.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The shorter a project's payback period, the less desirable the project is normally considered to be by this criterion.

B) One drawback of the payback criterion is that this method does not take account of cash flows beyond the payback period.

C) If a project's payback is positive, then the project should be accepted because it must have a positive NPV.

D) The regular payback ignores cash flows beyond the payback period, but the discounted payback method overcomes this problem.

E) One drawback of the discounted payback is that this method does not consider the time value of money, while the regular payback overcomes this drawback.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The regular payback method is deficient in that it does not take account of cash flows beyond the payback period.The discounted payback method corrects this fault.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Projects C and D are mutually exclusive and have normal cash flows.Project C has a higher NPV if the WACC is less than 12%,whereas Project D has a higher NPV if the WACC exceeds 12%.Which of the following statements is CORRECT?

A) Project D probably has a higher IRR.

B) Project D is probably larger in scale than Project C.

C) Project C probably has a faster payback.

D) Project C probably has a higher IRR.

E) The crossover rate between the two projects is below 12%.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

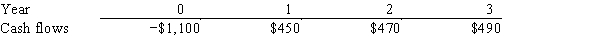

Multiple Choice

Anderson Systems is considering a project that has the following cash flow and WACC data.What is the project's NPV? Note that if a project's projected NPV is negative,it should be rejected.

A) $265.65

B) $278.93

C) $292.88

D) $307.52

E) $322.90

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 108

Related Exams