A) $17,100

B) $12,800

C) $15,500

D) $14,300

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the following question(s) .

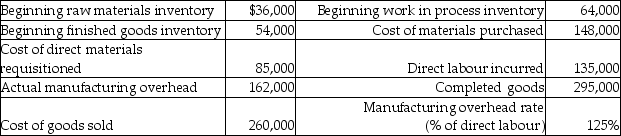

Here is some basic data for Callor Corporation:

-At Callor Corporation the entry to record the cost of goods sold would include a

-At Callor Corporation the entry to record the cost of goods sold would include a

A) credit to Cost of Goods Sold for $260,000.

B) credit to Finished Goods Inventory for $295,000.

C) debit to Cost of Goods Sold for $295,000.

D) credit to Finished Goods Inventory for $260,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

At a service company, the indirect costs of serving the client include manufacturing overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead has an overallocated allocated balance of $6,200; raw materials inventory balance is $50,000; work in process inventory is $30,000; finished goods inventory is $20,000; and cost of goods sold is $100,000. Which of these accounts would have an ending credit balance?

A) Manufacturing Overhead

B) Finished Goods Inventory

C) Work in Process Inventory

D) Cost of Goods Sold

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the following question(s) .

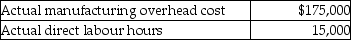

Before the year began, Johnson Manufacturing estimated that manufacturing overhead for the year would be $160,000 and that 12,000 direct labour hours would be worked. Actual results for the year included the following:

-At Johnson Manufacturing the amount of manufacturing overhead allocated for the year based on direct labour hours would have been

-At Johnson Manufacturing the amount of manufacturing overhead allocated for the year based on direct labour hours would have been

A) $160,000.

B) $167,500.

C) $175,000.

D) $200,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be appropriately costed using a process costing system?

A) Oil refining

B) A law firm managing individual legal cases

C) Assembly of individual aircraft by Bombardier

D) Movies produced by Lions Gate Entertainment

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Manufacturers follow four steps to implement a manufacturing overhead allocation system. The last step is to estimate the total amount of manufacturing overhead costs for the year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a perpetual inventory system, the journal entry needed to record the sale of a job includes a

A) debit to Accounts Receivable and credit to Sales Revenue.

B) debit to Finished Goods Inventory and credit to Cost of Goods Sold.

C) debit to Sales Revenue and credit to Accounts Receivable.

D) debit to Cost of Goods Sold and credit to Accounts Receivable.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the following question(s) .

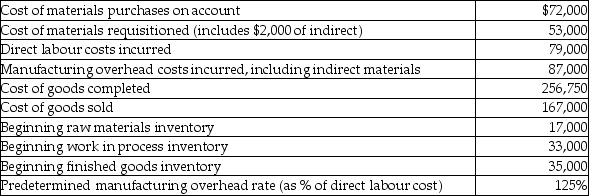

Here is some basic data for Shannon Company:

-For Shannon Company the journal entry to close the under or over applied overhead to cost of goods sold is as follows:

-For Shannon Company the journal entry to close the under or over applied overhead to cost of goods sold is as follows:

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information below to answer the following question(s) .

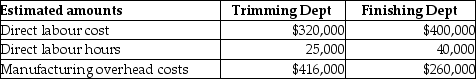

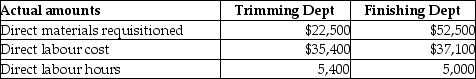

Solid Oak Bureau Company uses job costing. Solid Oak Bureau Company has two departments, Trimming and Finishing. Manufacturing overhead is allocated based on direct labour cost in the Trimming Department and direct labour hours in the Finishing Department. The following additional information is available:

Actual data for completed Job No. 650 is as follows:

Actual data for completed Job No. 650 is as follows:

-What is the predetermined manufacturing overhead rate for the Trimming Department?

-What is the predetermined manufacturing overhead rate for the Trimming Department?

A) 77% of direct labour cost

B) 107% of direct labour cost

C) 130% of direct labour cost

D) 100% of direct labour cost

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If manufacturing overhead has been overallocated during the year, it means the jobs have been overcosted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record $200 of depreciation expense on factory equipment involves a

A) debit to Manufacturing Overhead for $200.

B) debit to Accumulated Depreciation for $200.

C) debit to Depreciation Expense for $200.

D) credit to Manufacturing Overhead for $200.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these documents substantiates the balance of the raw materials inventory account shown on the company's balance sheet?

A) Raw materials records

B) Bill of materials

C) Materials requisition

D) Labour time record

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a manufacturing business, which of the following entries would be made to record $10,000 of labour of which 70% of is direct labour, and 30% which is indirect labour?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

At Plastics Source, Inc., the beginning balance of the work in process inventory account in April of the most recent year was $17,000. Direct materials used during April totaled $140,000. Total manufacturing labour incurred in April was $163,500, 80% of this amount represented direct labour. The predetermined manufacturing overhead rate is 120% of direct labour cost. Actual manufacturing overhead costs for April amounted to $155,000. In April, two jobs were completed with total costs of $102,000 and $82,000, respectively. In April, the two jobs were sold on account for $175,000 and $127,000, respectively. a) Compute the balance in work in process inventory on April 30. b) Record the journal entry for direct materials used in April. c) Record the journal entry to record labour costs for April. d) Record the journal entry for allocated manufacturing overhead for April. e) Record the entry to move the completed jobs into finished goods inventory in April. f) Record the entry to sell the two completed jobs on account in April.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the total manufacturing cost of Job 787 using an actual overhead rate?

A) $17,100

B) $12,800

C) $15,500

D) $14,300

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

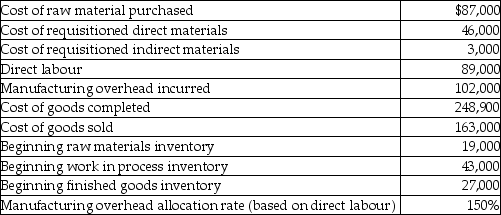

Use the information below to answer the following question(s) .

Here is selected data for Jenquay Corporation:

-At Jenquay Corporation the journal entry to transfer completed goods to the finished goods inventory account would include a

-At Jenquay Corporation the journal entry to transfer completed goods to the finished goods inventory account would include a

A) debit to Work in Process Inventory for $248,900.

B) credit to Work in Process Inventory for $268,500.

C) debit to Finished Goods Inventory for $248,900.

D) debit to Finished Goods Inventory for $268,500.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the sales price and the job cost is

A) cost of goods sold.

B) gross profit.

C) net income.

D) operating income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sullivan Company uses a predetermined overhead rate based on direct labour hours to allocate manufacturing overhead to jobs. The company estimated that it would incur $500,000 of manufacturing overhead during the year and that 100,000 direct labour hours would be worked. During the year, the company actually incurred manufacturing overhead costs of $590,000 and 120,000 direct labour hours were worked. By how much was manufacturing overhead overallocated or underallocated for the year?

A) $10,000 underallocated

B) $10,000 overallocated

C) $90,000 underallocated

D) $90,000 overallocated

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

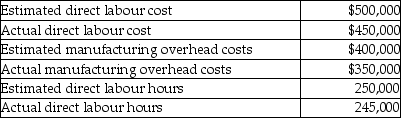

Use the information below to answer the following question(s) .

Sable Company is debating the use of direct labour cost or direct labour hours as the cost allocation base for allocating manufacturing overhead. The following information is available for the most recent year:

-If Sable Company uses direct labour hours as the allocation base, what would the predetermined manufacturing overhead rate be?

-If Sable Company uses direct labour hours as the allocation base, what would the predetermined manufacturing overhead rate be?

A) $1.60 per direct labour hour

B) $1.40 per direct labour hour

C) $1.43 per direct labour hour

D) $1.63 per direct labour hour

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 353

Related Exams